what is the property tax rate in dallas texas

The Texas sales tax rate is currently. On top of that the state sales tax rate is 625.

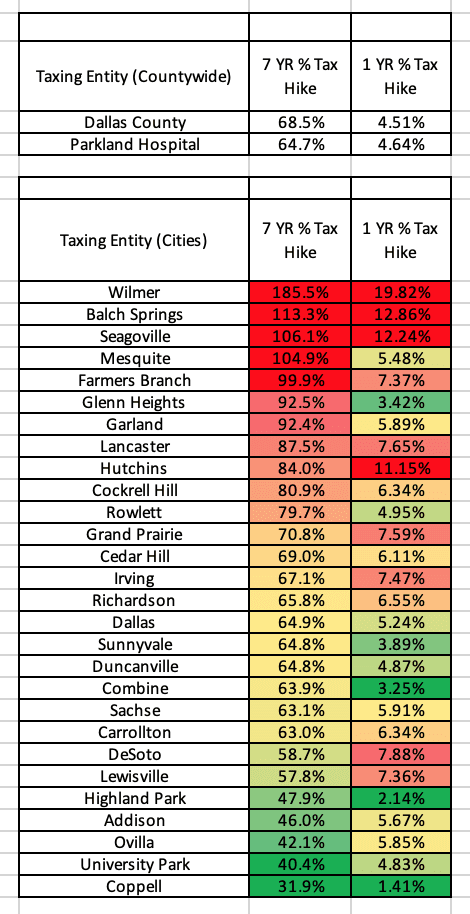

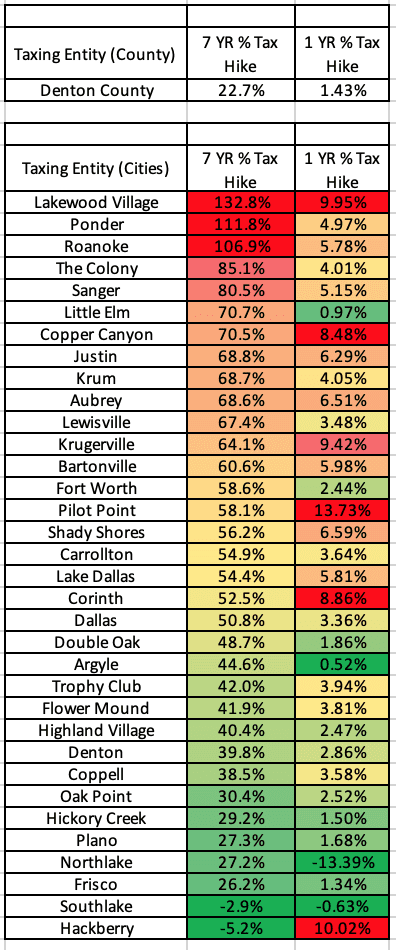

Homeowners Wallets Still Hit By City And County Property Tax Growth Texas Scorecard

Maintenance Operations MO and Interest Sinking Fund IS Tax Rates.

. Property Tax Rate Comparisons around North Texas. Texas has no state property tax. The median property tax on a 12970000 house is 282746 in Dallas County.

10 hours agoNationwide home price gains in January were the highest in at least 45 years. Texas law establishes the process followed by local officials in determining the value for property ensuring that values are equal and uniform setting tax rates and collecting taxes. It is the second-most populous county in Texas and the ninth-most populous in the United States.

That means thousands of dollars a year in property taxes for the typical Texas homeowner. According to the Tax Foundation that makes the overall state and local tax burden for Texas 76. This is the total of state county and city sales tax rates.

Addison Carrollton-Farmers Branch isd 252. This is currently the seventh-highest rate in the United States. And Dallas-area housing prices rose at an even faster rate.

Carrollton Dallas isd 256. 254 rows The average homeowner in Dallas County pays 3124 annually in property taxes and pays taxes at an effective rate of 193. Building Permits and Inspections.

If you have questions about how property taxes can affect your overall financial plans a financial advisor in Dallas can help you out. The Texas Constitution and statutory. So if your home is worth 200000 and your property tax rate is.

The current total local sales tax rate in Dallas TX is 8250. Learn about Southlake Texas property taxes from Southlake Top Realtor and Southlake Luxury Home Realtor Real Estate Agent - What is my southlake home worth. The County sales tax rate is.

Dallas single-family home costs were almost 22 higher. However if you are an individual over the age of 65 you have options to help alleviate the burden of high property taxes. The average property tax rate in Texas is 180.

In Texas there are ways to lower property taxes through exemptions because of the high property tax rate in the state. Tax Code Section 5091 requires the Comptrollers office to prepare a list that includes the total tax rate imposed by each taxing unit in this state as reported to the comptroller by each appraisal district. The minimum combined 2022 sales tax rate for Dallas Texas is.

179 rows Property tax tates for all 1018 Texas independent school districts are available by. The median property tax on a 12970000 house is 234757 in Texas. The Dallas sales tax rate is.

The 2020 census revealed that the Texas population had grown by 16 or 4 million people in the preceding decade. In Dallas County for example the average effective rate is 193. Texas has one of the highest property tax rates in the country with most properties seeing substantial tax increases year over year.

While the national average tends to fall between 108 and 121 Texas average effective property tax rate is above 183. For individuals 65 and older in Texas there is no way to freeze all property taxes. The Dallas property tax rates are calculated by the government and to make the payment we click on the green Pay Now button.

But high property taxes dont necessarily mean you should be a renter for life. More than half of that tax goes to local schools. Tax Rates and Levies.

This is quite appealing to those relocating from many other states around the nation. Licenses and Permits Licenses and Permits. One of the fantastic things about living in Texas is the absence of a state income tax.

As of the 2010 census the population was 2368139. Citiestowns total municipal school county school district county. Coppell Carrollton-Farmers Branch isd 253.

That being said Texas does fund many of their infrastructure projects etc. To estimate your real estate taxes you merely multiply your homes assessed value by the levy. Did South Dakota v.

The tax rates included are for the year in which the list is prepared and must be listed alphabetically according. Wayfair Inc affect Texas. Its county seat is Dallas which is also the third-largest city in Texas and the ninth-largest city in the United States.

Dallas Dallas isd 274. Coppell Coppell isd 269. Dallas County Property Tax Payment By Credit Card If we want to pay by credit card we fill in the option enter the desired value to pay enter the number of the card with which we are going to pay and click.

In Harris County where Houston is located the average effective property tax rate is 203. SNAP Food Stamps WIC Women Infants and Children TANF Temporary Assistance to Needy Families Health Care. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Dallas County Tax Appraisers office.

5 Things To Know About Texas Business Personal Property Tax. Carrollton Carrollton-Farmers Branch isd 256. Property tax rates other taxing units.

Breaking this out in dollars if your home is valued at 200000 your personal property taxes at the average rate of 180 would be 3600 for the year. Dallas County is a county located in the US. Dallas carrollton-farmers branch isd 274.

Addison Dallas isd 252.

Homeowners Wallets Still Hit By City And County Property Tax Growth Texas Scorecard

Property Tax Penalty Chart Texas Property Tax Penalties And Interest Chart Tax Ease

Homeowners Wallets Still Hit By City And County Property Tax Growth Texas Scorecard

If Dallas Property Tax Rates Are Going Down Why Are My Payments Going Up Mansion Global

How To Read Your Property Tax Bill O Connor Property Tax Reduction Experts Property Tax Tax Tax Reduction

Homeowners Wallets Still Hit By City And County Property Tax Growth Texas Scorecard

Property Tax Consultants Houston Property Tax Tax Consulting Property Valuation